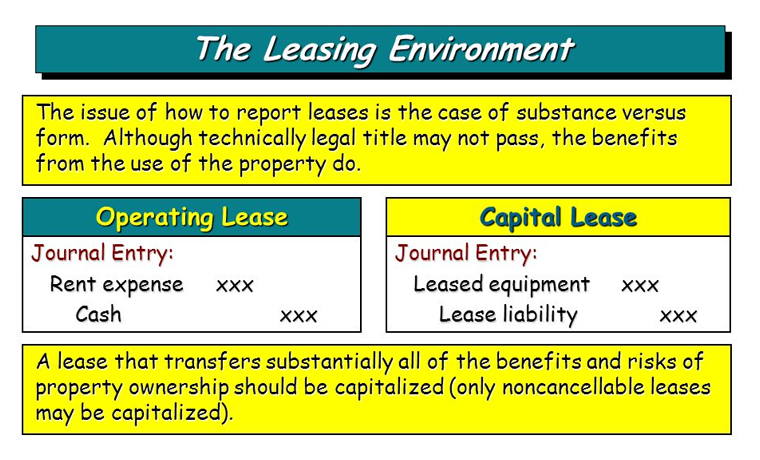

First up, equipment leases have two primary kinds, the capital lease and the operating lease.

Operating Lease

Basically, the operating lease is a structure being offered by a lessor to lessee to enable a business to utilize a specific property for a specific period of time without the ownership clause. The lease duration is, normally, shorter than the equipment’s financial life. So at the end of the lease, the lessor has the ability to recoup extra expenses through a resale option.

Unlike an equipment secured through a standard loan or outright purchase, devices under an operating lease cannot be considered as a capital investment because it is made up of rental costs. With a scheme as this, two monetary benefits could be received, which are:

- A device is not regarded as a liability or an asset.

- The equipment still gets approved for tax incentives.

Rates that dealers provide are all over the board, however, in general, the average APR for an operating lease is 5 percent or lower. Average contracts grow for about a year to three years.

With the popularity of leasing, brand-new accounting policies from the Financial Accounting Standards Board (FASB) require businesses to present their lease obligations so as to prevent the fallacy of possessing financial strength. In fact, according to the most recent reports, all but the shortest-term office equipment leases need to now be included on balance sheets. So while leased equipment does not need to be reported as a possession under an operating lease, it’s far from being perceived as not a responsibility.

Capital Lease

This is the second kind of equipment lease. Sometimes known as a finance lease, this structure is often similar to an operating lease because the lessor owns the devices acquired. However, it varies because the lease itself gets reported as a property, enhancing your company’s assets.

Commonly availed by big companies such as airline companies and large retailers, this setup renders a unique benefit because it enables the business to assert both the interest expenditure related to the lease itself and the depreciation tax credit on the equipment. In addition, the company could choose to purchase the device at the end of a finance lease term.

Considering the financial edge that this option provides, the APR for a finance lease is way higher and usually doubles that of an operating lease. Basic interest rates presently hover in between 5% to 10%. Average agreements, on the other hand, vary from 2 years to 6 years.

What are the obligations of a lessee during a lease term?

There are a number of extra obligations that could result in expenditures above and beyond the month-to-month cost of the lease payment. These items normally include:

- Extra costs: Depending on your lease structure, you might be held liable for some maintenance and repair services. Extra expenses like these could also consist of legal fines, fees, and certification costs.

- Return of equipment: This consists of shipping costs and transportation.

- Insurance coverage: The typical price quote for a liability insurance varies from $$250 to $2,000 each year, with numerous businesses reporting costs of $1,000 or less.

- Regular expenses: Read your written agreement carefully. Costs could be assessed for everything from a one-time “documentation cost” which usually runs to as much as $250 to “late-payment” costs, which is at least $25 or 15% of the amount overdue.